Reports Find Investments in Artificial Intelligence to Be Steady in 2020

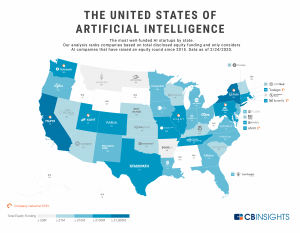

A CB Insights chart shows startups, which indicate new investments in AI. AI tech growth is expected to continue, regardless of economic trends. (Source: CB Insights)

The COVID-19 and oil price war between producers have caused huge drops in worldwide stock markets. Since no one can predict when the freefall is going to end, uncertainty rules the day. Some are asking whether the innovation and technical miracles happening on a weekly basis will dry up due to financial fears.

It’s worth noting that investment doesn’t necessarily take the form of equity stakes — all of the major technology companies bolstered their AI through acquisitions last year, a trend that’s grown steadily in recent years. Indeed, 2019 saw a record 231 AI startups acquired, according to CB Insights’ data, up from 42 in 2014. A

New reports shine some light on the investments made in artificial intelligence (AI) between 2015 and 2019, revealing that the U.S. attracted more than half of all global AI investments during the five-year period, followed by China and the U.K. According to a Forrester Report, companies will continue to invest and expand their AI projects in 2020, in spite of the looming economic collapse.

Forrester surveys found:

- 53% of global data and analytics decision makers say they have implemented, are in the process of implementing, or are expanding or upgrading their implementation of some form of artificial intelligence.

- 29% of global developers (manager level or higher) have worked on AI/machine learning (ML) software in the past year.

- 54% of global mobility decision makers whose firms are implementing edge computing say that the flexibility to handle present and future AI demands is one of the biggest benefits they anticipate with edge computing.

- 16% of global B2C marketing decision makers planned to increase spending on data and analytics technologies, including AI, by 10% or more this year.

The UK Tech For a Changing World report was produced by government-funded Tech Nation and focuses largely on the British digital economy. However, it compares the U.K.’s tech industry with that of other countries around the world, using data from myriad sources, including Dealroom, Pitchbook, Crunchbase, AON Radford, GSMA, and EY. In the foreword, Prime Minister Boris Johnson said the research “confirms the United Kingdom’s standing as Europe’s number one Tech Nation,” adding that the U.K. is leading the way in emerging technologies.

But the U.K is feeling the economic crash, too. A story on venturebeat.com explains what emerging technologies are seeing and how investing might occur during the downturn.

While the U.K. had a record year in acquiring investments in AI, the U.S. did as well or better according to stats in the article.

“In the space of a single year, we have shattered all records, with technology investment in the U.K. soaring by 44% to over £10 billion ($12 million) — more than France and Germany combined,” UK Prime Minister Boris Johnson said. “And we are number one in Europe for the emerging technologies that will transform the lives of every single human being.”

“Emerging technologies” are defined as AI, robotics, cybersecurity, blockchain, internet of things (IoT), virtual reality (VR), and augmented reality (AR). According to the report, 10 countries were responsible for 91% of all emerging technology investments in the past five years. The U.S. led the way with £75 billion ($92 billion) in inbound investments, followed by China ($22 million) and the U.K ($6 billion).

Moreover, 10 cities accounted for 44% of all emerging technology investment during the five-year period — San Francisco led the way with more than £16 billion ($20 billion) of the total investment, followed by Beijing ($12 million), New York ($7 billion), Santa Clara ($6 billion), and London ($5 billion).

Moreover, 10 cities accounted for 44% of all emerging technology investment during the five-year period — San Francisco led the way with more than £16 billion ($20 billion) of the total investment, followed by Beijing ($12 million), New York ($7 billion), Santa Clara ($6 billion), and London ($5 billion).

The information shows not all high-tech businesses are on a nonstop rise in their growth. Robotics, experienced a downturn in global investment last year, lending credence to the notion that hardware is hard — it fell from £9.1 billion ($11 million) to £7.1 billion ($8.7 billion) between 2018 and 2019. A similar trend has surfaced in other reports, including data released last month by the Association for Advancing Automation, which suggested that robotics shipments in the U.S. last year fell by 16%.

The change in the economy businesses are facing will be challenging to some, but not most high-tech companies, especially in the United States. According to a story by Bloomberg News on the financialpost.com, of the 100 top startups tracked by CB Insights, 65% of the most successful were U.S.-based. Also, a story on livemint.com noted that a Brookings Institution study last year confirmed those conclusions, and found that, “white-collar jobs are most likely to see an impact from AI, particularly in the life sciences and computer industries.”

read more at venturebeat.com

Leave A Comment