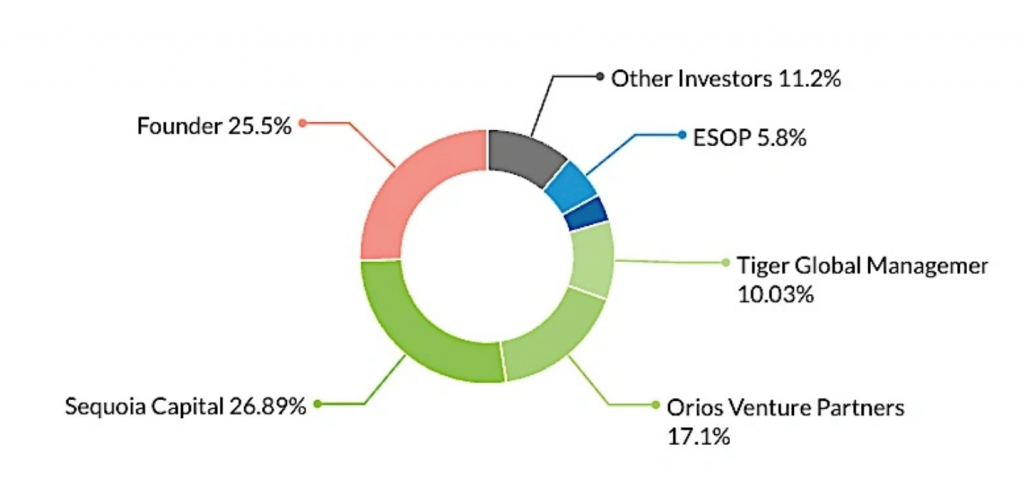

The cap table of GoMechanic, which has raised $62 million and was last valued at $283 million (post-money). (Source: Tracxn data/TechCrunch.com)

Online Car Service Startles Investors over Misleading Financial Statements

With the billions and billions of dollars moved daily into the tech sector, one might think that every business investment is a guaranteed winner. It’s not. And even people who are supposed to know how investing works are having to admit they aren’t always turning profits. Sometimes even the professionals get it wrong. Take the example of Sequoia Capital and GoMechanic. Here is a piece we found from techcrunch.com that makes it clear that “due diligence” is vital in all investing.

According to techcrunch.com, GoMechanic is struggling to raise investments after reports about fictitious numbers in its financial report. The start-up provides an online car servicing platform intended to help people to schedule their car servicing online at a desired time. Its platform books services like denting and painting, exterior and interior car care services and cashless insurance repairs, enabling users to service their cars in a hassle-free manner.

The India-based car service was in talks early last year to raise a round of funding led by Tiger Global at over $1 billion valuation, TechCrunch reported. The talks did not materialize into a deal after some discrepancy was found during the due diligence process, a source said.

GoMechanic later engaged with several other investors, including Malaysia’s Khazanah to raise a large round. Khazanah was positioned to lead the round whereas SoftBank was also looking to participate.

This new round is no longer proceeding as serious discrepancies have been found in its books, two sources said, requesting anonymity speaking to the press.

An investigation into the 7-year-old startup by EY as part of the due diligence for the recent funding deliberation found scores of issues, including inflated revenue and that some garages were fictitious, two sources said.

“The debacle at the startup—which is fast-running out of cash in its bank and needs a new infusion soon to survive, according to a source familiar with the matter—is the latest headache for Sequoia India, the most influential venture investor in the South Asian market. Zilingo, BharatPe, and Trell, three other Sequoia India-backed startups, have had governance and auditing issues in the past year.”

In a joint statement, GoMechanic investors said the startup’s founders recently informed them of the “serious inaccuracies in the company’s financial reporting.”

“We are deeply distressed by the fact that the founders knowingly misstated facts, including but not limited to the inflation of revenue, which the founders have acknowledged. All of this was kept from the investors. The investors have jointly appointed a third party firm to investigate the matter in detail, and we will be working together to determine the next steps for the company,” the investors added.

Perhaps the next step for GoMechanic would be to find a good accounting firm before seeking more funding.

read more at techcrunch.com

Leave A Comment