Investors Hear the Crash of Cryptocurrency FTX’s Collapse, Causing Domino Effect

Whether you are a cryptocurrency investor or user of crypto in place of cash money, or if you are just a crypto observer so to speak, you have been made aware of the disaster that was the FTX cryptocurrency.

Prosecutors said FTX was a “house of cards” through which Mr. Bankman-Fried and others diverted customer money to buy expensive real estate in the Bahamas, invest in other cryptocurrency firms, provide themselves with personal loans and make political contributions of tens of millions of dollars intended to influence policy decisions on cryptocurrency and other issues.

The indictment of Mr. Bankman-Fried accuses him of conspiring with unnamed others to violate campaign finance laws that prohibit corporate donations to candidates’ campaigns and bar donations “in the names of other persons,” commonly known as straw donations. He is also charged with wire fraud, money laundering, and securities fraud related to his management of FTX and another company he co-founded, Alameda Research.

“It’s relatively simple for someone to create a token,” said Riyad Carey, research analyst at crypto data firm Kaiko. “But these tokens can obviously lose interest extremely quickly.”

What Was FTX?

FTX is a now-bankrupt company that was one of the world’s largest cryptocurrency exchanges. It allowed customers to trade digital currencies for other digital currencies or traditional money; it also had a native cryptocurrency known as FTT. The company, based in the Bahamas, built its business on risky trading options that are not legal in the United States.

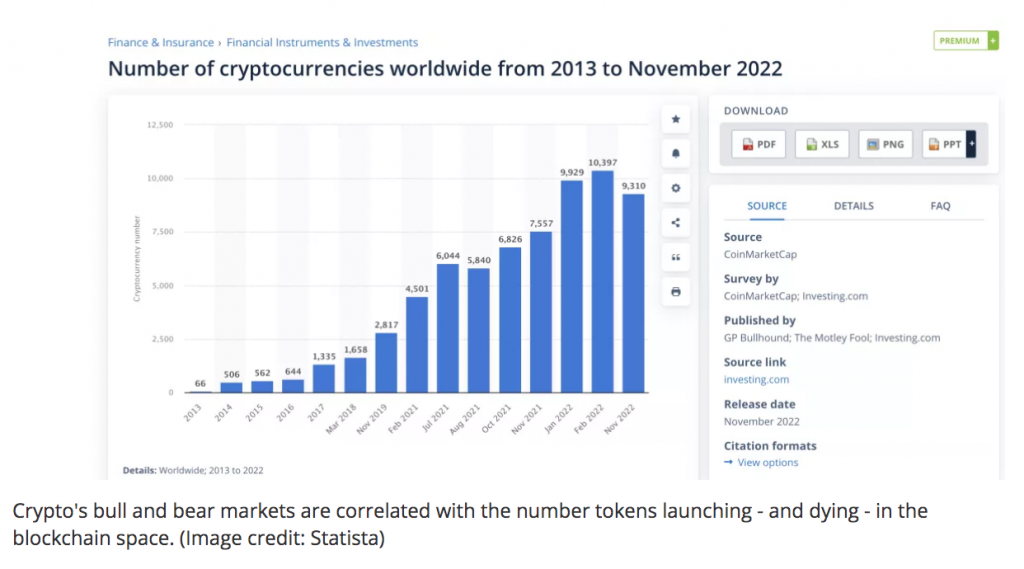

Now that we have touched on FTX, did you know that in 2022 nearly 1,000 cryptocurrencies have folded along with FTX? In a piece we found at tomshardware.com, the author Francisco Pires pointed out some of this year’s biggest failures according to the agencies that keep track of cryptos.

Since peaking at 10,397 in February 2022, the number has dropped by about 1,000, the biggest-ever decline in the 13-year-old crypto industry’s volatile history.

Names like Storeum debuted its own new cryptocurrency in July 2019. And like so many others, Storeum was a cryptocurrency that had no liquidity backing it.

Storeum has since gone mostly quiet. Its website no longer works and its social media accounts are inactive. The token technically still exists, in zombie form, as a contract on the Ethereum blockchain. This year, the STO has taken another step toward oblivion: It has vanished from the pricing site CoinGecko, which lists nearly 13,000 cryptocurrencies that are still considered viable in some form.

CoinGecko officials would not confirm when exactly Storeum was deactivated from its website. But a cursory search using the Wayback Machine, which archives websites from prior dates, shows that a Storeum token page was still active as of early 2022. Now, typing Storeum into CoinGecko’s search bar turns up with no results.

And this is just one of the so many tokens that have caused investors such huge losses. Even the big daddy of tokens, Bitcoin, has lost 66% of its value this year.

Cryptocurrency is a grand idea that may yet find a place in the world of business and finance. However, with this complete meltdown of FTX, the best advice anyone can give you about any cryptocurrency is to be very careful about how you invest.

There are many unvetted tokens, and many exchanges trying to bring in new crypto investors. And there are just as many people out there that have no scruples about taking money for nothing to back it.

read more at tomshardware.com

Leave A Comment