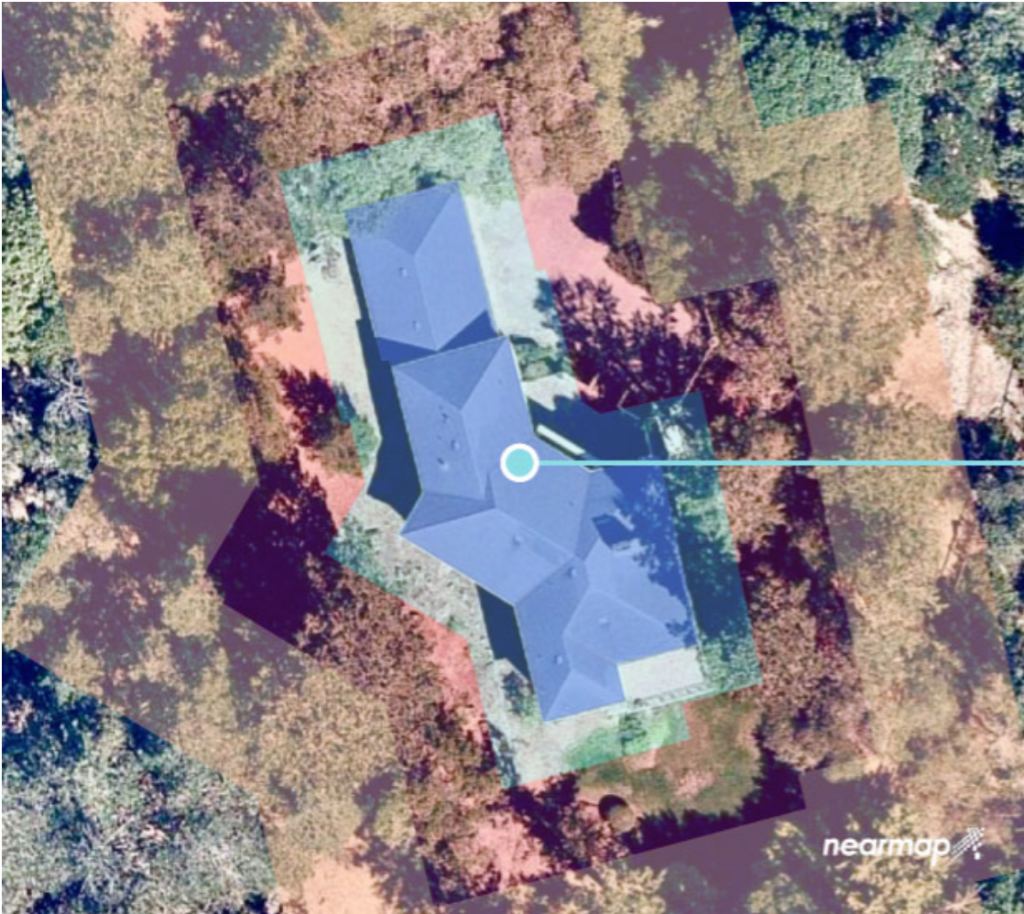

Capital Analytics has found success with AI property roof evaluations using Nearmap high-resolution images.

AI Evaluates Real Estate Remotely Using AI, Aerial Views

While trying not to sound repetitive with our stories about how AI has been introduced to almost every type of business you can think of, we remain excited about the weekly strides in AI that we report. And now comes a tale from venturebeat.com written by Paul Sawers that shows how one company is raising major funds to bring AI even deeper into the real estate markets nationwide.

Cape Analytics, a company meshing AI with aerial imagery to power property insurance inspections, has raised $44 million in a Series C round of funding.

Founded in 2014, Mountain View, California-based Cape Analytics enables insurance providers such as AXA and Western Mutual to optimize their underwriting process by leveraging computer vision and geospatial imagery to evaluate properties without having to send someone out to physically inspect them.

By adapting the usual way of doing things and bringing AI into the equation, you have practically guaranteed your company will take a major jump in production, quality control, and many other aspects of any business. That all takes funding.

Example of Cape Analytics aerial analysis of a roof.

Manual inspections can be a hazardous and resource-intensive process, often involving climbing onto roofs. Instead, Cape Analytics garners high-resolution aerial photos from third parties like Nearmap and then analyzes and extracts structured data from the imagery. Data might include the size of the property, the roof’s condition, what it’s made of, whether there are solar panels, or even whether any trees overhang the building.

By using these analytics, Cape Analytics says they can not only tell you the state of the property currently, but they can spot and address future deterioration or damage.

Cape Analytics had raised $31 million over a couple of rounds of funding in the past seven years, and the company is now well-financed to expand on its existing 50 subscription-based customers from across the insurance and real estate spheres.

“The idea [with this funding] is to add, blend, and compare additional high-quality sources while also exploring new forms of data — for example, weather data or home sales information, and much more,” a company spokesperson told VentureBeat.

The information Sawer includes in his article will make you wonder why others aren’t doing things the way Cape Analytics is doing them.

read more at venturebeat.com

Leave A Comment