ThetaRay wins the “Transaction Security Innovation Award” in the 2021 FinTech Breakthrough Awards.

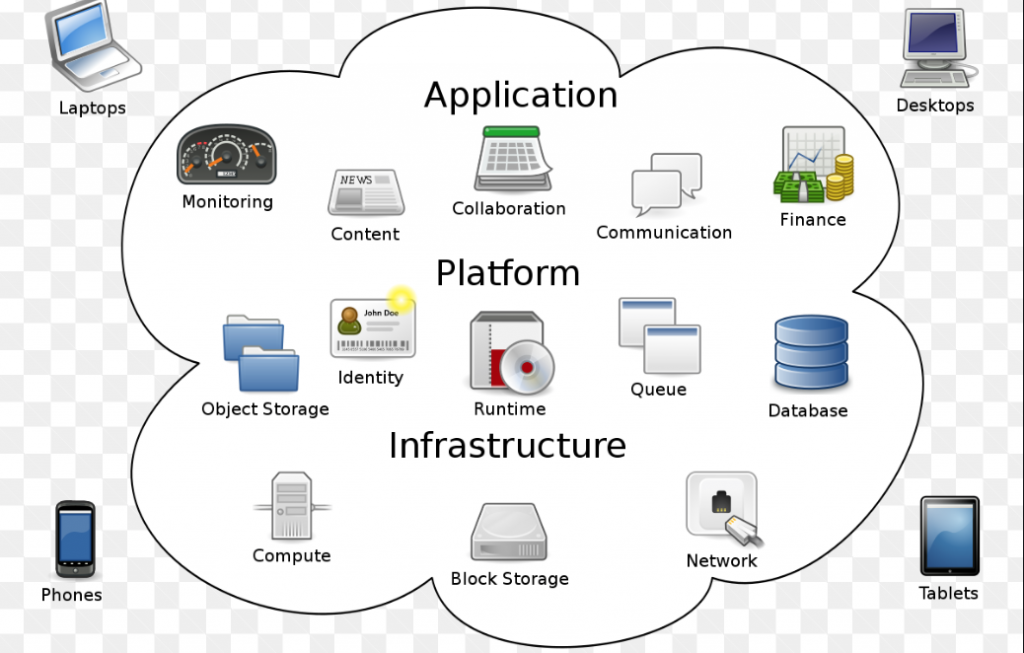

New Software Compatible with Public and Private Clouds

When it comes to financial crimes, it doesn’t get much bigger or harder to track than money laundering. The illegal movement of billions, perhaps trillions of dollars has long been a concern of governments around the world. In fact, the efforts to control money laundering produced a treaty decades ago between 200 countries to cooperate in the fight against this crime.

There is even software for AI that has been added to their crime-fighting toolbox. AML or anti-money laundering software became popular in the early 2000s for customer transactions, identity management, and regulatory compliance. In recent years, providers like ThetaRay, Unit21, C3, and Splunk have developed increasingly intelligent solutions to analyze laundered money’s first two stages: placement (where it’s deposited into a bank) and layering (which involves transferring money before integrating and extracting it)

In a detail-packed article from venturebeat.com, we learned a lot about the banking profession and its growing use of AI. Manasa Gogineni writes about a level in finances that most of us never pay much attention to, as it does not affect us directly. Or does it?

ThetaRay announced recently that its AI-based anti-money laundering (AML) analytics will be available on public and private clouds, including Azure, Google, and AWS.

ThetaRay’s AML platform uses unsupervised machine learning to monitor financial transactions, integrating data and triaging alerts in real-time. And its new cloud-agnostic version aims to increase the speed at which the cybersecurity company’s clients — banks and fintech firms — can detect potential threats.

And now with the introduction of cryptocurrencies, world governments are relying even more heavily on AI oversight to keep things on the level. AML efforts have become even more complicated. Whether complicated means difficult is controversial, however. Internet service providers make anonymity a gamble, and some industry leaders say cryptocurrencies identify and prevent illegal activities better than traditional payment systems do.

Crossborder Problems Abound

Cloud-based systems became particularly important to banks during the COVID-19 pandemic as they scrambled to understand more data in less time. ThetaRay says its new service is the only cloud-based AML offering that analyzes SWIFT traffic, risk indicators, and client data to detect anomalies indicating “money laundering, terrorism financing, and other criminal activities across complex, cross-border transaction paths.”

According to ThetaRay, its platform also helps users reduce operational costs and increase revenue by relying on its “artificial intuition” proprietary machine learning technology that interprets supervised and unsupervised data with fewer false positives.

ThetaRay was founded in 2013 as the brainchild of Tel-Aviv University computer science professor Amir Averbuch and Yale math professor Ronald Coifman. In their first year, they managed to raise $10 million investments to get the ball rolling.

When VentureBeat interviewed Gazit in 2018, he said “Human beings are not enough to look at all this data, and we’re lucky to have tens of years of academic research to analyze all those … transactions.”

Just taking into consideration the number of day-to-day banking transactions that take place around the world, it is not possible for humans or even dated software to keep accurate records. This new software says it can do all that and more with AI.

“Our fully scalable cloud service … empowers the payments ecosystem to enjoy the long-term operational benefits of secure cross-border transactions without having to worry about the maintenance of additional infrastructure,” Gazit said.

With so much in this article, we have just touched on a few of the main points about this new fintech-based AI software, which was recognized at the 5th annual FinTech Breakthrough Awards.

read more at venturebeat.com

Leave A Comment