Apple Takes Advantage of COVID Crisis with Buying Spree

During the nearly international COVID-19 lockdown, people are staying home, working from home and doing recreation from home. Even though nonessential businesses have been ordered to stand down for this crisis, some big tech companies have decided now would be a good time to pick up a few tech bargains on the market. Apple is leading the race.

Fortune.com focused this week on Apple’s buying spree of start-ups and companies that are ripe for picking.

“The economist Paul Romer is credited with the expression ‘a crisis is a terrible thing to waste.’ Apple seems to be taking the maxim to heart, using its massive balance sheet to go shopping at a time equity values are plummeting,” the Fortune story begins.

Apple started the buying spree with weather app Dark Sky, giving it a chance to add a popular map and weather app while cutting out Android phones users from access to it. Then Apple announced it’s buying Voysis, an artificial intelligence software company that makes voice-assistance tech, an app that might improve Siri. The Dublin-based company with offices in Boston and Edinburgh has created digital assistants that understand everyday language better.

Next up? An augmented reality company called NextVR. Apple declined to explain its plans for the company’s tech, but considering that Apple+ is a potential venue for NextVR’s broad number of live sports, music and entertainment offerings on all VR platforms, it’s likely the two will intersect with content and VR.

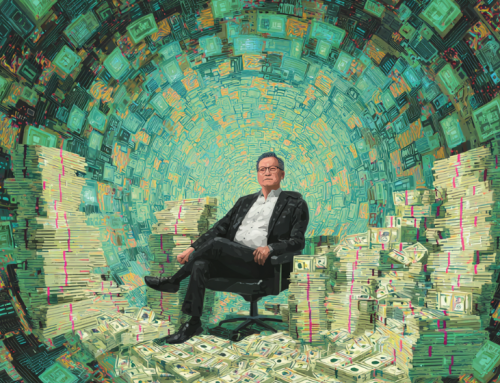

Dave Cole, co-founder and CEO of NextVR, a company that Apple bought, among others, as valuations of tech companies fall. (Source: NextVR)

A month ago, financial advisers nearing retirement looked to cash in on record-high firm valuations and record-level merger and acquisition activity. Now companies are struggling to close deals on investment capital and vulture investors are circling.

Apple’s purchases come after the valuation peak and as companies begin to lose value. Last year, independent broker-dealers and registered investment advisers completed 139 transactions representing $781.1 billion, a 43% more transactions and a 38% increase in assets compared to 2018, according to Fidelity Investments mergers and acquisitions data. By February, companies racked up seven transactions totalling $6.2 billion.

Then COVID-19 led to a stock market crash. Recovery is not expected any time soon, meaning tech companies will likely need to adjust to a bear market and tech giants like Apple can snap up bargains.

read more at fortune.com

Leave A Comment