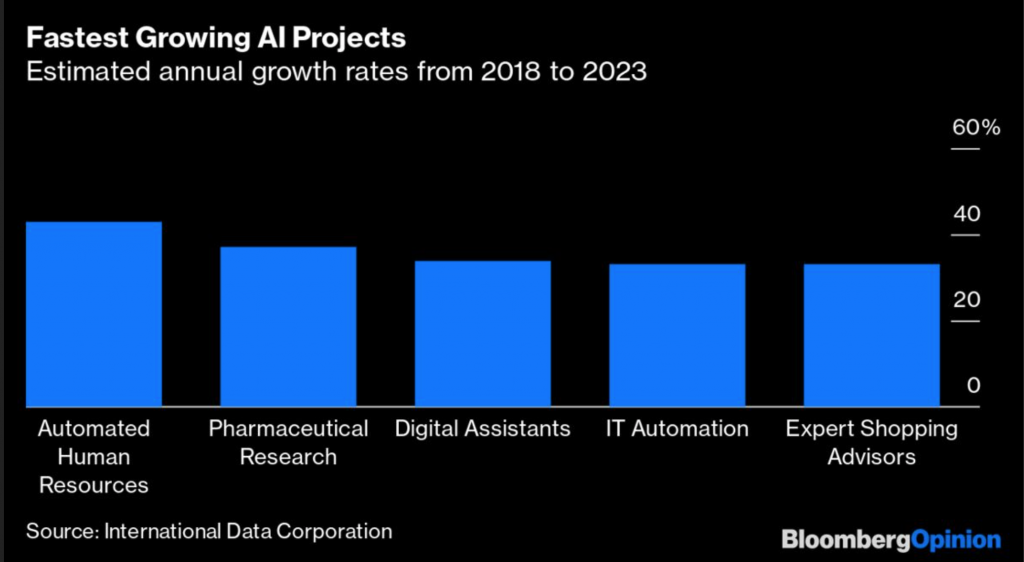

This chart from International Data Corporation (IDC) shows the projected areas of greatest AI growth. (Source: Bloomberg)

Bloomberg Columnist Predicts Rapid Ascent of AI in Business

A Bloomberg columnist predicts AI will surge forward as companies spend money on cloud-computing technologies to adapt to a world in which remote work is the norm. The opinion piece by Tae Kim, a tech writer who previously wrote for Barron’s, was posted on bloombergquint.com.

Despite only 20% of companies currently using AI as part of their enterprise tech, analysts point to a sharp increase, especially since the COVID-19 pandemic began, Kim writes.

“Big Tech has already demonstrated how useful AI can be in fighting Covid-19. For instance, Amazon.com, Inc. partnered with researchers to identify vulnerable populations and act as an ‘early warning’ system for future outbreaks. BlueDot, an Amazon Web Services startup customer, used machine learning to sift through massive amounts of online data and anticipate the spread of the virus in China.”

Before the virus hit, CIOs and IT leaders told Gartner in a survey that they planned to “double” their number of AI projects, and 40% planned to do so by the end of the year. International Data Corporation (IDC) projected that global AI spending would more than double in four years from $38.4 billion in 2019 to $96.3 billion in 2023.

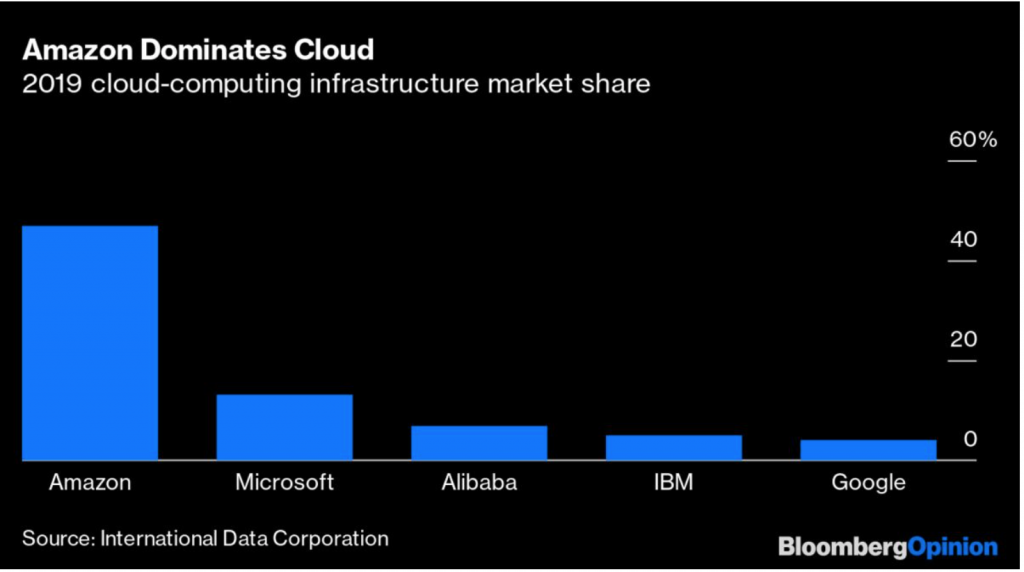

Cloud computing has grown in 2020 based on the need of companies to adapt to COVID-19 realities. (Source: Bloomberg)

Ecommerce, too, has benefited from the pandemic lockdown, as consumers avoid retail stores. Their data on shopping habits are boosting online sellers long-term.

“Bank of America’s internal card-spending data for e-commerce points to rising year-over-year revenue growth rates of 13% for January, 17% for February, 24% for March, 73% for April and 80% for May,” Kim writes. “The data these transactions generate is a goldmine for retailers and AI companies, allowing them to improve the algorithms that provide personalized recommendations and generate more sales.”

Kim speculates on potential winners and losers as the market shifts, including chip maker NVIDIA as a beneficiary of the growth due to its graphics chip being adapted for AI by cloud computing companies. The losers may be server legacy system sellers like Hewlett Packard Enterprise Company and router-maker Cisco Systems, Inc.

Kim also points out the downsides of rapid AI growth, specifically job loss, baked in biases and invasion of privacy.

read more at bloombergquint.com

Leave A Comment