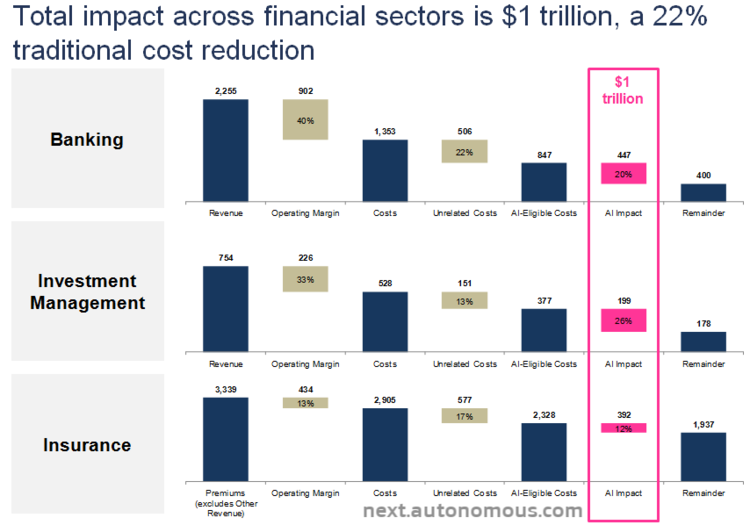

AI Will Revolutionize Financial Services, Save $1 Trillion

AI and machine learning could very well decimate financial industry jobs in the next decade, according to a story in Fast Company, which cited figures of 2.5 million jobs replaced by machines for a total of a trillion dollars saved.

Financial services, such as insurance sales and tellers, are already being replaced by online and ATM technology, but AI will speed up the process, according to a report by Autonomous, a research firm.

Increased processing power coupled with big data and neural networks mean the system have the ability to process information more rapidly than ever. Such skills as image recognition has already surpassed that of humans.

Lex Sokolin, global director of Fintech Strategy for Autonomous, said the one thing AI can’t yet do is “content switching,” meaning the systems are designed for narrow uses, such as processing and identification, and can’t switch to other tasks—yet.

“Banking and lending could see the largest change, he says, with 1.2 million jobs at risk and a potential $450 billion in savings. Insurance follows, with 865,000 jobs at risk and a projected $400 billion in savings. Lastly, there are 460,000 jobs at risk in the investment management sector, equivalent to as much as $200 billion in savings.”

Sokolin predicts that by 2030, fintech using AI will save financial services businesses $1 trillion per year.

read more at FastCompany.com

Leave A Comment