Soros Fund Seeks to Invest in Cryptos Due to Bitcoin ‘Bubble’

Billionaire George Soros’ $25 billion family office Soros Fund Management aims to begin trading in cryptocurrenices, according to an article published by Bloomberg on April 6 citing internal sources.

Soros Fund Management overseer Adam Fisher sought and gained approval to begin crypto investing, though it’s unclear whether George Soros was personally involved in the decision. Also unknown is which cryptoassets the fund will invest in. This leads to leading to speculation within crypto communities across the web as to which cryptocurrencies the Soros fund might back or, conversely, if the fund might short popular cryptos much in the way that Soros profited heavily from betting against the pound sterling in 1992.

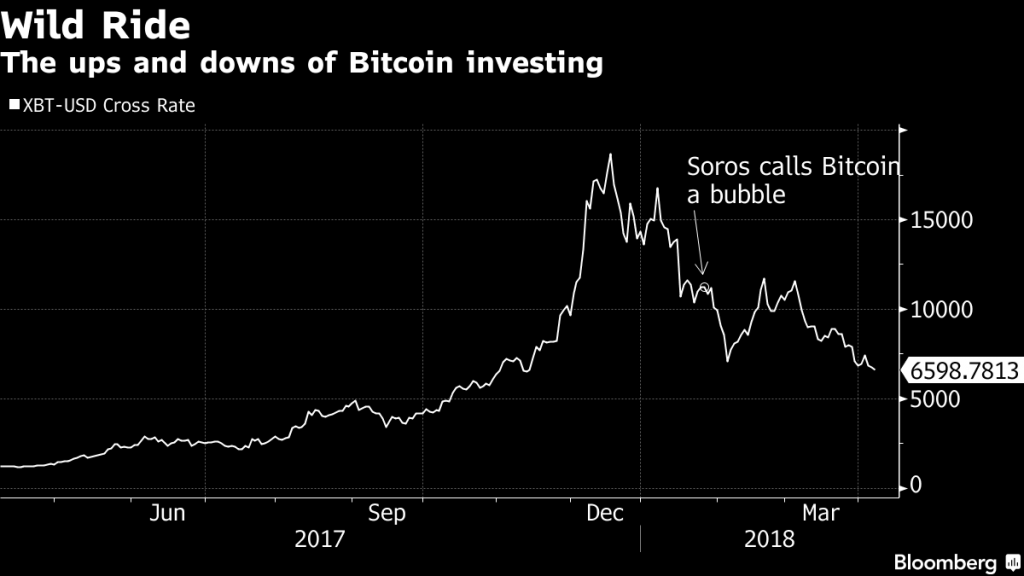

Bloomberg’s report follows conspicious remarks by Soros earlier this year when he discussed cryptos at the World Economic Forum in Davos, Switzerland on January 25. While acknowledging positive uses of cryptocurrencies’ underlying blockchain technology including some in use by his own organizations, Soros derided rampant speculation in what he described as a Bitcoin “bubble.” Additionally, Soros described the very concept of a “cryptocurrency” as a misnomer, arguing that assets with such volatile swings in value held no utility as currencies.

Clairvoyant analysis or self-fulfilling prophecy? Soros called the Bitcoin/crypto boom a “bubble”, foretelling crypto’s precipitous crash and slow bleed this year.

Leave A Comment