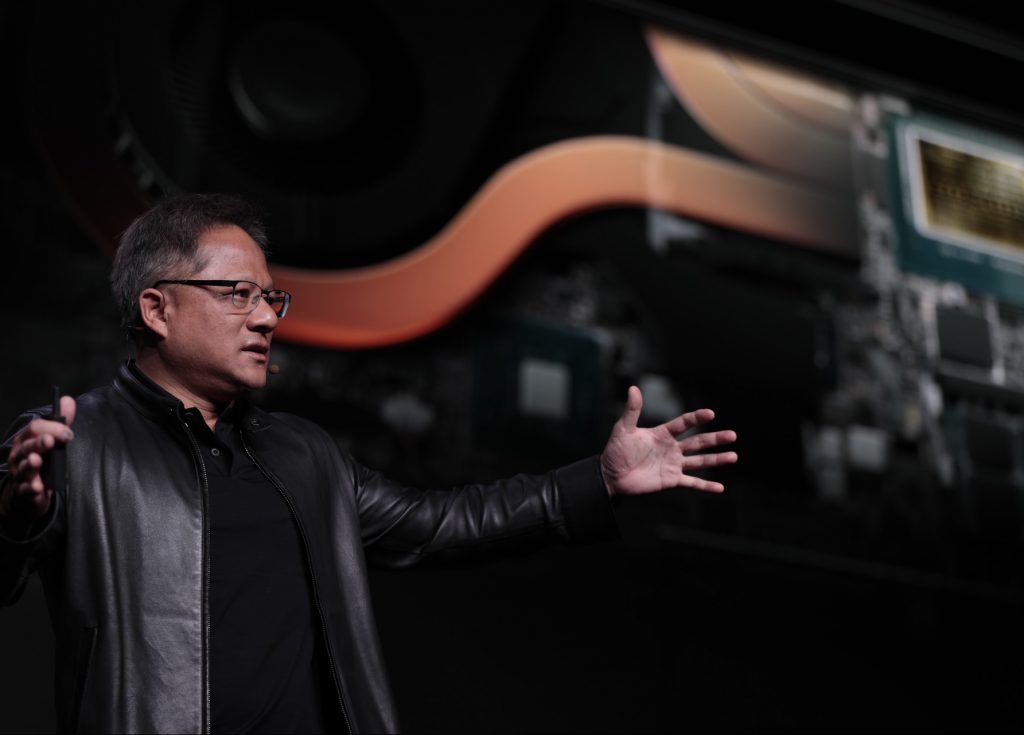

Nvidia Corp. CEO Jensen Huang speaks at the Consumer Electronics Show in 2019. (Source: Nvidia Corp. via Flickr)

Generative AI Chip Demand Boosts Nvidia Stock Price to 1-Day Record

Some financial numbers are in and Nvidia is having a record-breaking first quarter according to finance.yahoo.com. The explosion in AI is carrying over to Nvidia due to their computer chips which are essential in the new graphics that companies like Midjourney and others are requiring.

Shares of the chip giant exploded 27% in pre-market trading on Thursday as results trounced analyst estimates. The company’s ticker page was the most active on the Yahoo Finance platform, followed closely by rival chip players such as AMD (AMD) and Intel (INTC).

Nvidia’s stock numbers were astounding for just a run-of-the-mill May 25 in what has been a pretty bullish market as of late.

If the pre-market gains in Nvidia hold, the company’s market value would rise more than $200 billion, which would mark the biggest one-day rise in history. Apple’s $191 billion pop in November 2022 is the current record holder.

AI Chips

It is easy to how interconnected much of the digital industry is. Nvidia founder and CEO Jensen Huang told analysts on the conference call the very upbeat outlook reflects a fundamental shift to accelerated computing. In other words, the new surge of generative AI is taking lots of other companies along with its expanding use by the public.

“We’re seeing incredible orders to retool the world’s data centers,” Huang said. “And so I think you’re seeing the beginning of, call it, a 10-year transition to basically recycle or reclaim the world’s data centers and build it out as accelerated computing. You’ll have a pretty dramatic shift in the spend of a data center from traditional computing and to accelerate computing with SmartNICs, smart switches, of course GPUs and the workload is going to be predominantly generative AI.”

Will It Lead to Shortages?

Several stock professionals weighed in on the Nvidia uptick and reported that Nvidia planners saw this growth coming and took steps to stock up on the needed materials to give them a currently adequate supply for the huge jump in demand.

Atif Malik, Citi (Buy rating; $420 price target, up from $353):

“While we had raised our target price and estimates into the earnings, Generative AI upside was bigger than we expected. Nvidia expects data center sales to roughly double in the July quarter driven by Gen AI demand from CSPs, consumer internet companies, and accelerated computing in enterprises. Nvidia estimates only ~4% of the $1 trillion data center CPU installed base over the last four years has been GPU accelerated, implying AI adoption remains in the early innings.”

It’s the start of what is proving to be the biggest news in computing over the last ten years. From ChatGPT to even newer versions of chatbots flooding the markets it is clear that users are finding these tools very useful if not already essential in their jobs or their hobbies in computing.

Perhaps Dave Ives of Wedbush summed up today’s Nividia stock explosion;

“There is not one better indicator around underlying AI demand going on in the hyperscale/cloud and overall enterprise market than the foundational Nvidia story. We view Nvidia at the core hearts and lungs of the AI revolution given its core chips train and deploy generative AI applications like ChatGPT. The Street was all awaiting last night’s Nvidia quarter and guidance to gauge the magnitude of this AI demand story with many skeptics saying an AI bubble was forming and instead Jensen & Co. delivered guidance for the ages.”

“Guidance for the ages” is a pretty strong compliment but could prove to be just what this evolution in AI needs.

read more at finance.yahoo.com

Leave A Comment