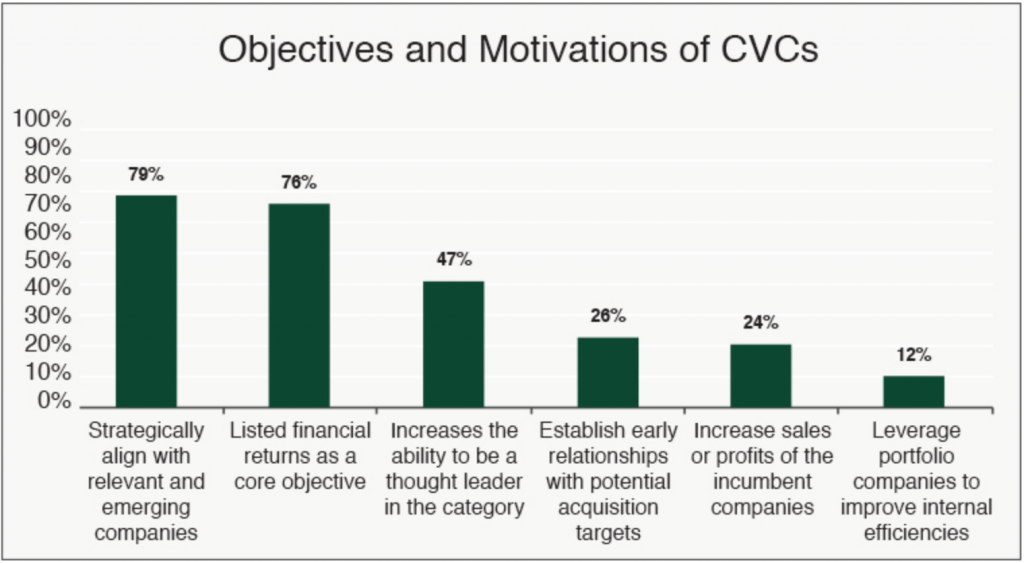

A chart from a CB Insights report shows the benefits of Corporate Venture Capital funds, which the HBR report recommends pooling in joint ventures so that mid-sized companies can take advantage of proprietary AI development.

Harvard Business Review Recommends JVs for Companies Traditionally Left Out

While “start-ups and giants” are the typical beneficiaries of AI tech, a Harvard Business Review story says family-run mid-sized companies that are struggling to keep up are in jeopardy in areas like health care, finance, retail, media and cross-industry tech. According to a study of German firm-level data collected in 2019 by the Leibniz Centre for European Economic Research (ZEW), of more than 6,000 firms surveyed, only about 10 to 15% of midsize firms had adopted AI, compared to a third of large corporations of over $1 billion in revenues.

The story by authors Yannick Bammens and Paul Hünermund says that to remain competitive, companies that make between €50 million and €1 billion in annual revenues ($59 million and $1.18 billion in U.S. currency) will need a different strategy from the well-capitalized big corporations and the start-ups that gain venture capital boosts.

Instead, they will need to leverage their investments through joint ventures.

“Pooling data and data analytic skills from across firm boundaries may be one of few options available to midsize firms to remain competitive in the new data-fueled economy,” the article states. “These joint AI ventures can be set up by vertical value-chain partners, horizontal sector partners, or a combination of both.”

Three benefits of setting up such a structure include sourcing and organizing data from across multiple participating firms to train and deploy machine learning (ML) algorithms for a variety of cost-saving and revenue-boosting business applications.

“Through data pooling, the vertical approach to these joint ventures can convert a fragmented view of value-chain activities into a cohesive thread, with ML algorithms using rich user data from downstream partners to inform firm operations, or input data from upstream partners to inform dynamic pricing. Likewise, the horizontal approach can exploit partners’ pooled data to increase the accuracy of ML-trained back-office systems or the quality of AI-augmented offerings.”

That would work if the companies are in different geographic areas and aren’t competing with each other, the article notes.

Secondly, they can pool resources with one or more firms to create their own AI solutions, instead of buying off-the-shelf solutions that may not ideally serve their companies.

“By sharing financial resources in an ambitious joint AI venture initiative, these companies will be better able to build in-house AI talent and ML algorithms capable of leveraging unique cross-firm data lakes.”

Third, along with being able to attract in-house AI talent and developing ML algorithms capable of leveraging data from two or more firms, they will also be able to benefit from their own startup development by pooling corporate venture capital to support the venture.

The story further explains the risks and rewards of this approach.

read more at hbr.org

Leave A Comment