AI merges expertise with stock trading for large firms.

Imperial Execution Uses AI to Make Enormous Stock Trades

The stock market surge in the last two years has been impacted by the use of AI to execute mammoth deals. Making the market even more robust is exactly what Imperative Execution has in mind.

By using the latest in AI technology, the company expects to make even larger trades possible. A reuters.com story explains the latest approach using a new platform called IntelligentCross.

Imperative Execution runs IntelligentCross, a trading platform known as an alternative trading system (ATS) that was launched in September, in the six months has matched more than 1 billion shares. To be sure, the company faces tough competition against 31 other ATSs and 13 stock exchanges like Nasdaq Inc and Intercontinental Exchange Inc’s New York Stock Exchange, which together have matched around 6.5 billion shares each day this month.

Imperative Execution runs IntelligentCross, a trading platform known as an alternative trading system (ATS) that was launched in September, in the six months has matched more than 1 billion shares. To be sure, the company faces tough competition against 31 other ATSs and 13 stock exchanges like Nasdaq Inc and Intercontinental Exchange Inc’s New York Stock Exchange, which together have matched around 6.5 billion shares each day this month.

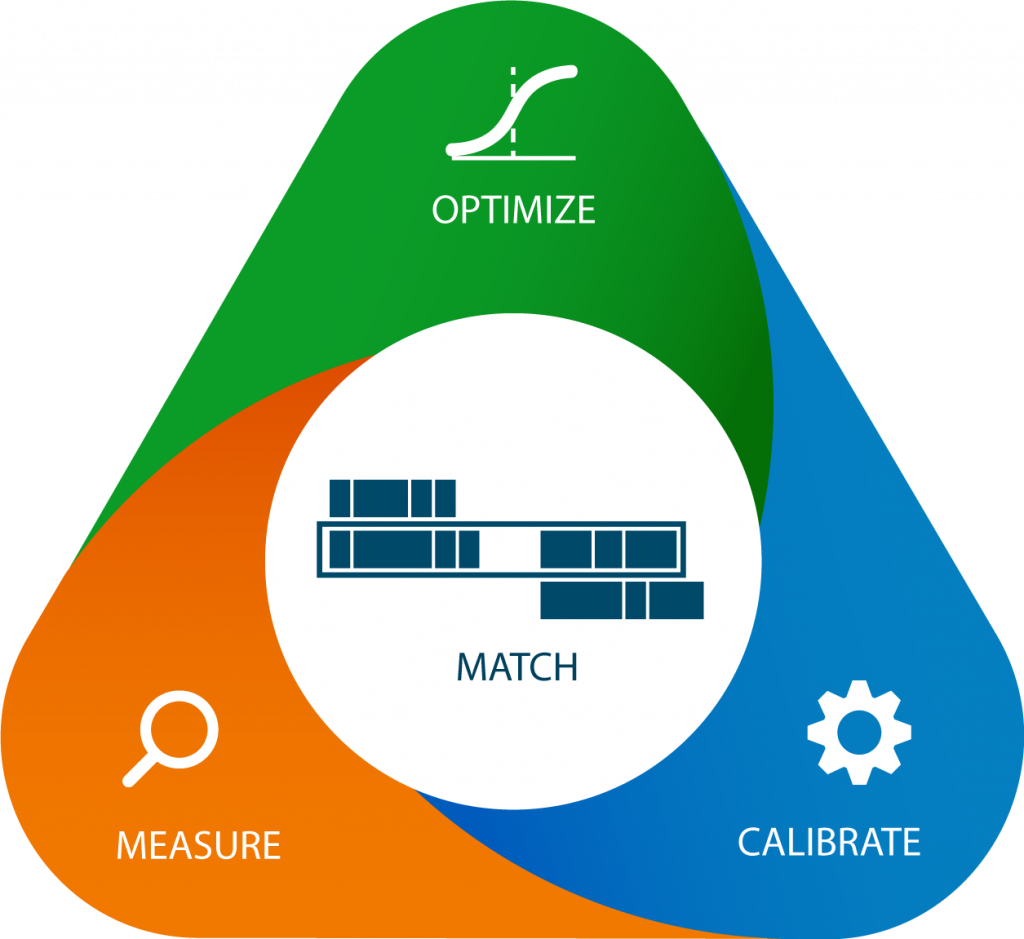

What sets IntelligentCross apart is that AI is a key feature of the ATS. Founder and Chief Executive Roman Ginis said his firm uses AI to measure the outcomes of trades in real time and then adjusts trading schedules to help brokers get better executions and save its clients money.

“We want to build venues that solve for particular trading outcomes,” said Ginis, a former trader at Cubist Systematic Strategies, the computer-driven trading arm of Steven Cohen’s hedge fund Point72, in an interview with Reuters.

This is a brief description of how it works.:

The ATS currently uses an AI-assisted order type that randomly matches undisplayed orders at the midpoint of the market’s best bid and offers every few milliseconds, rather than when the orders arrive.

It then measures how much specific stock prices move and shifts the intervals between matching times to minimize price movements after the following trades.

But not everyone thinks AI is going to replace the human stockbroker or analyst. Marketwatch.com says:

Put simply, AI works well when the trading objective is obvious. But when it is complex and hard to describe, there is no substitute for human judgment.

In WWll, when planes would come back to their base all shot up, the question was posed “Should we reinforce the places where the bullets hit?”

Abraham Wald, the famous Columbia University statistician, told the company otherwise: Reinforce where the bullet holes weren’t. Why? Because he — a human — understood there was information in the planes that didn’t return. Yes, the planes that made it back were shot, but that wasn’t fatal. That was luck. To continue that luck, reinforce the parts of returning planes that were clear.

That highlights how what might be counterintuitive to a machine is may be very intuitive to a human with a full understanding of where the data come from. AI will get better, but it is far from mastering that skill, Wald said.

read more at reuters.com

Leave A Comment